Latest Updates

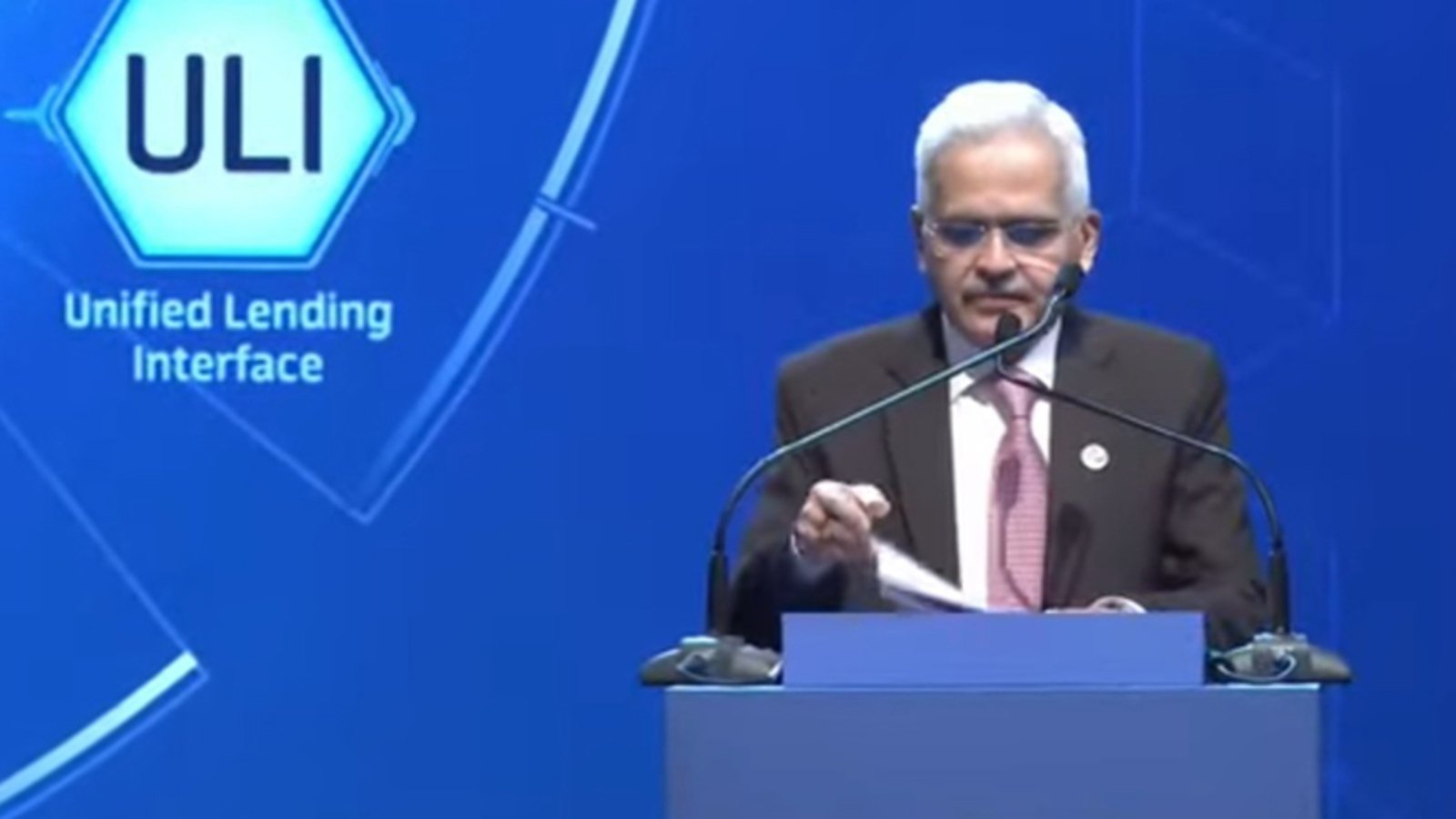

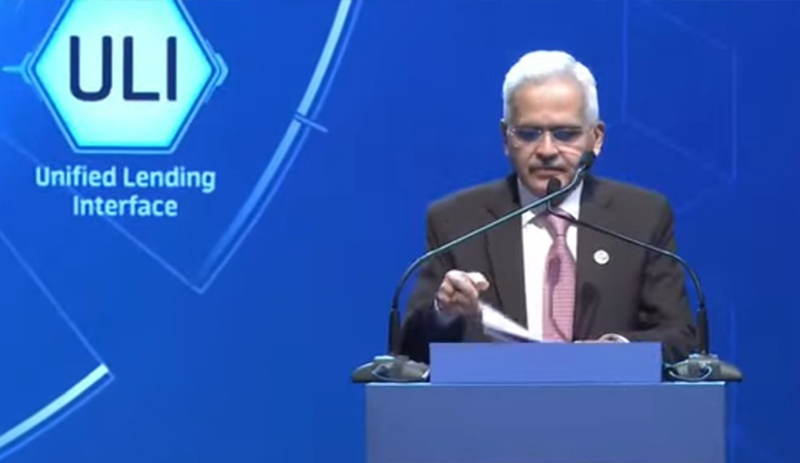

"RBI Governor Shaktikanta Das Announces New 'Unified Lending Interface' for Frictionless Credit During RBI@90 Conference"

At a recent keynote address during the Global Conference on Digital Public Infrastructure and Emerging Technologies in Bangalore, as part of the RBI@90 initiative, RBI Governor Shaktikanta Das unveiled an innovative development in India’s financial infrastructure: the Unified Lending Interface (ULI). This new platform, currently in its pilot stage, is set to revolutionize the way credit is extended across the nation by introducing a “frictionless credit” system.

Governor Das highlighted that the ULI is designed to simplify and streamline the process of securing loans, making it quicker and more accessible for individuals and businesses alike. By reducing the complexities traditionally associated with loan applications, the ULI aims to enhance the efficiency of the banking sector and improve the overall user experience.

This initiative reflects the Reserve Bank of India’s ongoing commitment to integrating advanced technologies into the financial system, thereby promoting greater economic inclusivity and supporting sustainable growth. The ULI’s nationwide launch, expected soon, is anticipated to have a significant impact on the availability and accessibility of credit, fostering entrepreneurial ventures and stimulating economic activity across various sectors.

As the platform moves from pilot to full implementation, it promises to set a new standard for lending in India, aligning with global trends in digital banking and finance. This initiative not only underscores the RBI’s role in shaping the future of India’s financial landscape but also highlights its proactive approach in adopting emerging technologies to meet the evolving needs of the economy.

![CBEIClogo[1]](https://cbeic.in/wp-content/uploads/2025/10/CBEIClogo1.png)